Money market: Taxes and bond prices

Taxes can cause bond prices and interest rates to differ. For example, the U.S. government bonds have a lower risk of default and higher liquidity than municipal bonds, whereas municipal bonds are the state and local government bonds. However, the interest rates of municipal bonds are consistently lower than U.S. government bonds for the last 50 years because investors do not pay U.S. taxes on the interest they earn on municipal bonds while they pay U.S. government taxes on U.S. government securities. If you bought municipal bonds, subsequently, you would earn a lower interest than U.S. government securities. Nevertheless, you pay no taxes, compensating you for the greater risk and lower liquidity.

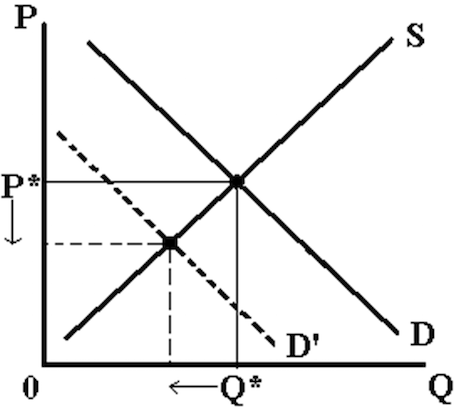

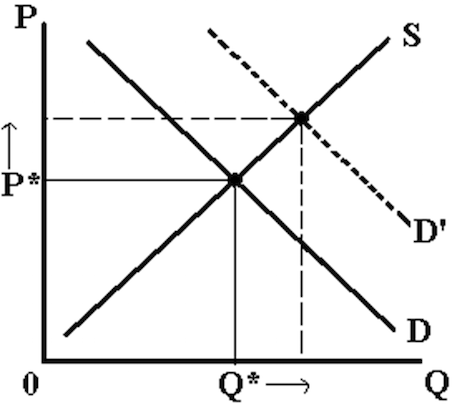

Demand and supply analysis shows the impact of taxes on the bond markets in Figure 4. Government taxes both the municipal and non-municipal bonds while the default risk, liquidity, and information costs are equivalent for both markets. Consequently, bond market prices have the same market price, P* and pay identical interest rates.

U.S. Government has exempted municipal bonds from federal taxes. Thus, investors are attracted to municipal bonds, boosting their demand, increasing the market price and decreasing the market interest rate. On the other hand, the taxed bonds are not as attractive as an investment, so investors buy fewer bonds, causing bond prices to fall and interest rates to rise. Therefore, municipal bonds have a lower interest rate than U.S. government bonds.

Taxed bonds

Municipal bonds

Source: Ken Szulczyk. “Taxes and Bond Prices.” Money, Banking, and International Finance. Boundless, 21 Jul. 2015. Retrieved 28 Oct. 2015 from https://www.boundless.com/users/233416/textbooks/money-banking-and-international-finance/risk-and-then-structure-of-interest-rates-9/risk-and-then-structure-of-interest-rates-30/taxes-and-bond-prices-96-15194/