School In A Box/How to run a self-sufficient school

INTRODUCTION

The objective of this chapter is to provide you with the tools to be able to run a Financially Self-Sufficient School.

Financial self-sufficiency refers to the state of not requiring any outside aid, support or interaction for survival, as we have made poignant in the last few chapters. We could clarify this as a type of personal or collective autonomy – in this case referring to the school not only creating funds but also making itself independent by the use of these funds to run the school.

As the world struggles with economic hardship, societies have begun trusting the private sector to do the work that governments are often failing to do. All too often in the developing world governments are not able to, or do not find importance in financially support areas such as education when there are more “crisis” areas needing attention that impact them directly.

Organisations have hence taken on board the struggle against poverty with open eyes, and many have found that creating financially self-sufficient projects is a great tool for leading the way forward. Whether this be enterprises or schools, the model is always based on the same premise – if you can be financially self-sufficient, your success will not be dependant on financial support from the market.

The administration of a self-sufficient agricultural school may not be very different from that of a commercial or industrial enterprise. It does however have a very unique characteristic due to the fact that the school is working with students who are simultaneously the main figures of its success, since educational excellence is the final goal.

In this chapter you will find valuable information that will help you understand and breakdown the vital areas needed in your school’s administration, which will help you manage the school and the chosen businesses succesfully.

Contents

- 1 THE ADMINISTRATION

- 2 ACCOUNTING

- 2.1 a. What is accounting?

- 2.2 b. Whay is accounting important?

- 2.3 c. What are the caratheristics of the records?

- 2.4 d. What factors are involved in creating accounting records?

- 2.5 e. What is production accounting?

- 2.6 f. What are the difficulties of production accounting?

- 2.7 g. What is the objective of agricultural accounting?

- 2.8 h. What are the factors of agricultural production?

- 3 ACCOUNTING AND AGRICULTURAL COSTS

- 4 FINANCIAL STATEMENTS

- 5 BUDGET

- 5.1 a. What is a Budget?

- 5.2 b. What are the elements of a budget?

- 5.3 c. Why should I make a budget?

- 5.4 d. What factors influence the creation of a budget?

- 5.5 e. How do I budget different areas?

- 5.6 f. How do I begin creating a budget?

- 5.7 g. How can I tell if I am on the right path when making my budget?

- 5.8 h. When should I adjust my budget?

- 6 INTERNAL CONTROL

- 6.1 a. What are internal controls?

- 6.2 b. Internal control at an agriculture school

- 6.3 c. Who carries out internal controls and why?

- 6.4 d. What are the elements of a good internal control system?

- 6.5 e. What should be controlled?

- 6.6 f. How are productive activities recorded and controlled?

- 6.7 g. What are control charts?

- 6.8 h. How much does an internal control system cost?

- 6.9 i. How do internal controls work in an educational environment?

- 7 ACCOUNTING AND MENAGMENT

- 7.1 a. What is an accounting software program?

- 7.2 b. Why is accounting program important?

- 7.3 c. How will this software help the edministrator?

- 7.4 d. What kind of reports will the program produce?

- 7.5 e. Why is this information important for decision-making?

- 7.6 f. What functions should the program have?

THE ADMINISTRATION

The objective of this section is to provide you with an overall view of what it means to run a self-sufficient agricultural school and the elements that are needed for effective and efficient administration.

a. Why is administration important?

Administration is the human component that directs the activities of an organisation and strives to achieve the anointed objectives. Good infrastructure, the best equipment and the best location have little impact without an administration.

Administration is a universal process: it is found in every kind of society, from capitalist to socialist and every kind of business, large and small alike. In actual fact wherever a social institution exists there will be administration.

Productivity and the standard of living in developing countries can be raised by means of administration. It makes human effort effective and helps to obtain better staff, equipment, materials, finance and also encourages better interpersonal relations. Most important, administration keeps track of changing conditions and provides foresight and creativity.

b. What is administration?

Administration is the process of ensuring that a group has:

• A plan of action to achieve their common goal

• Effective organization

• The sensible delegation of tasks

• A well-integrated staff compliment

• Clear direction and control

Successful administration will create and maintain an environment in which the members of the group can:

• Perform enthusiastically

• Fulfil their potential

• Operate effectively and efficiently

c. What is an administrator?

An administrator is someone who:

• Makes decisions that increase profits.

• Makes the best use of available resources.

• Manages to achieve stated objectives.

Therefore, the two main roles for the administrator are to:

- Establish the objectives for the school

- Identify how to get the best results from the available resources

The administrators needs to understand that there are two ways to increase the return/risk quotient:

1. Increase the numerator (income) while trying to keep the denominator (expenditures) down.

2. Keep the numerator (income) constant while causing the denominator (expenses) to decrease.

The efficient administrator must pursue this objective of becoming financially self-sufficient using either of these strategies. There are many administrators who successfully manage all aspects of their school, but we are also convinced that many of them need to make a serious effort to keep up with the changing times, in order to be able to ensure the survival and growth of their institutions.

1. ESTABLISH THE OBJECTIVES FOR THE SCHOOL

The objectives serve as a guide for the administrator and must be taken into account when each decision is being made in order to consider whether the consequences of a given course of action will lead to the accomplishment of the objectives better than any other.

Any school that is run without taking into account what you want to achieve is like a boat without a rudder: you have no control over where it is heading.

When you establish objectives it is very important to keep in mind the following points:

• They should be written down: This way everyone involved can review them and will be able to compare them with what happens in the future, to decide whether they have been achieved or not.

• They should be specific: “Increase income by $5,000 a year” is better than “Increase income.”

• They should be measurable: The objective of increasing income by $5,000 a year is measurable thus each year the administrator can easily see the degree to which the objective was achieved.

• They should have a time frame: “Increase income by $5,000 a year in the next two years” is better than not establishing a time frame for achieving the objective.

While it’s true that every business seeks to earn money, there are different ways to express this. Furthermore, in agricultural activities we may also have additional objectives. Below we present a list of possible objectives:

• Financial Self-sufficiency for the school – within how many years?

• Increase net income – by what expected percentage?

• Maximize profits - achieve the best possible return on investment

• Maintain or improve standard of living – according to designed requirements

• Reduce debt or subsidies – in what payment periods?

• Maintain stable income - establish a minimum income for a given year

• Increase the size of the operation, add land – by how much and when?

• Maintain soil fertility and water resources – monthly standard checks

Usually multiple objectives are established, making it necessary to establish priorities. Some objectives may be in conflict with others making prioritizing even more important. Undoubtedly no school can survive over time without generating the resources necessary to be self-sufficient. This objective therefore becomes directly or indirectly (as being necessary for the achievement of other objectives) the most important.

2. IDENTIFY HOW TO GET THE BEST RESULTS FROM THE AVAILABLE RESOURCES

You must consider the resources you have available to help you achieve your objectives. When it is time to establish objectives, the quantity of land, workers and capital available, need to be taken into account. This is vital so that the objectives are based on the reality of each specific school and are not just wishful thinking.

Another resource that should be taken into account is the administrative capacity of the school. Determining the existing resources and the possibilities for expanding these is one of the main responsibilities of the administrator. The administrator must concentrate all of his efforts on achieving the best combination of resource available so that all are effectively applied to the achievement of the objectives.

Questions such as the following should be considered:

• Whether to work in agriculture, livestock or a mix of both?

• What proportion of land will be dedicated to agriculture?

• What crops will you grow?

• What livestock will you work with?

• What technology will be used for production?

• What marketing strategy will be applied?

• How will the school’s finances be structured?

Finding answers to these and the many other questions that come up at a school is undoubtedly a complex task, requiring that the administrator be familiar with the different tools that permit him to identify problems and make the best decisions when the moment arises.

d. What are the function of the administrator?

These are some of the functions of an administrator:

- Planning/ Control

- Organization /Direction

- Coordination Supervision and Implementation

From this list we can extract an administrator's three basic functions:

1. PLANNING

This is the most important function and refers to establishing the most effective course of action to be followed. Not much can happen without a plan.

2. IMPLEMENTATION

Once it has been developed the plan must be carried out! This function includes acquiring the necessary resources and putting the planned process into action. We can include coordination, direction and supervision within this function.

3. REVIEW

This includes following up on results, generating new information and taking corrective measures. In this way we see if the consequences of our activities are in keeping with what had previously been planned and can take whatever measures are necessary to correct any deviations that may have been detected.

e. What human resources does the administrator need?

Human resources can be classified in the following categories: academic, production and administrative.

1. ACADEMIC HUMAN RESOURCES

Both the instructors and the academic employees should focus their efforts around the Educational-Productive Plan, in which the final objective of the FSS school is to turn financially challenged students into succeful citizens, fully exercising their rights and conscious of their responsibilities.

2. PRODUCTION HUMAN RESOURCES

Staff should have sufficient knowledge of the area in which they were hired to work and be able to concentrate their efforts on production and marketing goals for each product. For example if the school has a dairy, the person responsible for milk production should be oriented not just towards production but also towards satisfying the internal demand (student dining room) and external demand (processing, raw milk sales). Moreover they must understand the production and marketing functions needed to achieve the goal of self-sufficiency for the school.

3. ADMINISTRATIVE HUMAN RESOURCES

Administrators are of fundamental importance, as they allow the school to function in an orderly fashion and make sure information is available when necessary and in the proper format. In order for administrative support to work adequately, it is also necessary to have the following :

• Personnel file

• Job descriptions

• Organization chart

Below we give an example of anorganization chart in which you can see the emphasis on self-sufficiency as the goal of the self-sufficient agricultural school.

ACCOUNTING

The objective of this chapter is to provide you with the necessary information about accounting, its importance and the benefits of having an accounting system that allows you to obtain relevant information on time, easy to understand and properly formatted.

a. What is accounting?

Accounting is an economic science that aims to provide information on the past, present and future economic situation with the goal of facilitating financial decisions, planning and control. The business world is perpetually advancing by huge steps and the school’s accounting must keep up in order to keep their businesses competitive.

b. Whay is accounting important?

In our day-to-day life we all need to have a certain amount of control over what our income and expenses are. We need to know what needs we must address and what resources we can use. Without this control we would risk for example using up our resources by the middle of the month, not knowing how much we owe on a loan from the bank and then finding ourselves without the funds to make the loan repayment.

This task may be simple in the context of a family (it is enough to have a notebook to write down expenditures and calculate the money still available) but it depends largely on how many operations are going to be recorded. In FSS Schools there is a sufficiently large amount of information that will need a structured recording method to ensure financial efficiency.

The school can move a large quantity of money in one day and carry out multiple operations that need to be recorded. This recording can’t be done haphazardly, it must be in a done in a clear, orderly and methodical way so that the director or anyone else can refer to it, and understand the recordings at any later stage without problems.

As administrator of the agricultural school you will need a record-keeping system which allows you to know at any given moment the situation of the school, its business transactions and also have the information available which allows you to make decisions.

c. What are the caratheristics of the records?

Accounting records must:

1. Be exact. Accounting records cannot have errors or omissions. If these occur there should be a mechanism built into the system which makes it easy to locate and correct them.

2. Be simple. The records should be easy to understand and manage by the responsible person and it should be possible to interpret them quickly. If the system is complicated, it will demand an unjustified input of time and effort.

3. Be complete. If you forget to include a vital piece of data the records will lose all value since the information in them will not be a correct depiction and may lead to errors in the management of the school.

4. Be designed ahead of time. Before being put into use they should be carefully planned and evaluated to avoid duplicating information. They should also be tested to ensure that they serve the intended purpose.

d. What factors are involved in creating accounting records?

The way you go about creating accounting records will depend heavily on:

• The education level of those responsible for the administration of the school

• The interest of the school’s directors in having useful and reliable information to make decisions

• The size of the farm and its planned organization

The type of records could vary from the simplest single-entry accounting to the most complex double-entry accounting. The decision as to what system needs to be used is affected by understanding what businesses your school will integrate. It encompasses all activities that involve the use of the land and includes cultivation of crops and livestock work in all of their forms.

e. What is production accounting?

Production in any industry including agriculatural production should:

• Give reliable information about the production process

• Help establish financial controls

• Enable good decision-making through the provision of information

• Give the information necessary to comply with tax requirements

• Help the farmer to plan improvements to the infrastructure of his farm

• Allow greater knowledge of business management and the profitability of the business

• Allow comparisons between different periods and the opportunity to correct past errors

• Provide the information necessary when seeking credit

For these reasons, all agricultural businesses should use accounting methods, whatever the size of the operation.

f. What are the difficulties of production accounting?

Applying accounting principles to production and / agricultural activity generates a series of difficulties unique to the type of economic activity. With regard to agricultural activities, here are some accounting challenges:

1. The normal growth of animals, which implies a change in value, must be considered in terms of the final purpose of the animal. According to their final purpose, animals can be considered factors of production or products. If a caw is sold for meat it is a product, if it is kept and raised as a dairy cow it is a factor of production. Animals can also serve a different purpose as they grow older. For example after a useful life as a dairy cow, a cow could become a product such as an animal sold for rendering meat.

2. There can be difficulty in distinguishing family income and expenditures from business income and expenditures.

3. Agricultural activity depends on certain factors beyond human control, the weather for example.

4. The assessment of production costs for crops that are growing or being processed depends on the crops’ stage of development.

5. Instead of receiving monetary compensation for their work, the owners of an agricultural business can consume their product directly.

6. A combination of crop and livestock activities complicates the accounting process as each activity must be calculated separately.

7. The presence of students as a source of labor is a unique factor that must be accounted for.

g. What is the objective of agricultural accounting?

The administration of a FSS School seeks to answer the following questions:

1. WHAT should we produce?

2. HOW will we produce it?

3. WHEN will we produce it?

To develop an outlook regarding these three questions, directors need information that is accurate and timely telling them how internal and external markets are moving in order to plan what should be produced and at what cost. The administration gets this information through the agricultural accounting record, which it makes available to the director so that he can make correct and timely decisions.

Due to the fact that changes are frequent in the market for agricultural products, the producer should have techniques for investigation and making projections which allow him to make frequent changes in the production process. Knowing the respective costs of production, projection and diversification of new crops helps him make better decisions when the time comes to decide what it is most profitable to produce.

h. What are the factors of agricultural production?

Agricultural activities depend upon four fundamental factors for production:

1. LAND

Land has a set value. It is the base factor of agricultural activity since all of the other factors of production such as animals, material and minerals depend upon it.

2. LABOR

• Human labor (teachers and students)

• Animal labor

• Mechanical labor

• Investigative and technical labor

3. CAPITAL

Capital consists of the economic and financial resources that the FSS School has available to carry out production. This could include money, property, machinery, equipment etc.

4. ADMINISTRATOR

The administrator is responsible for efficiently combining the three previous elements to generate the production and income of the agricultural school. The administrator always seeks to achieve better results with the final aim of financial self-sufficiency.

ACCOUNTING AND AGRICULTURAL COSTS

The objective of this section is to inform you about the costs of production, the variety of agricultural activities and how to record them using accounting principles.

a. What are the costs of producation?

The costs of production are the expenses necessary to maintain a project or operating unit example the dairy of a school. The difference between income from sales and other sources and the cost of production is called the gross income of an operating unit. The total cost of milk production includes the costs of cattle feed, sanitation and direct labour.

b. What are agricultural costs?

All agricultural schools need financial resources to acquire supplies and the means of production such as seeds, herbicides, fertilizers, insecticides, animals and feed, machinery and equipment, facilities and structures, hired labor etc. The costs of agricultural schools can be grouped categorically as:

1. LAND

If owned cost of soil depletion, or rented when the producer does not own the farm.

2. LABOR

Payment to permanent or temporary laborers and value of labor provided by these laborers or by students of the agricultural school.

3. LONG-TERM MEANS OF PRODUCTION

Machinery and other equipment; facilities and structures.

4. CONSUMABLE MEANS OF PRODUCTION

Seeds, herbicides, fertilizers, insecticides and fungicides.

5. EXTERNALLY CONTRACTED SERVICES

Milling and mixing of grain to create animal fodder, transport of products / animals and mechanical services such as plowing or raking.

6. OPERATING COSTS

• Electricity and communications (telephone, radio)

• Fuel and lubricants

• Materials (to repair roads, buildings, fences, etc.)

• Maintenance (facilities, machinery and equipment, etc.)

• Depreciation

• Insurance

It is extremely important to distinguish expenses from costs. Costs are resources used directly for production while expenses are payments that can be applied to one or more periods of production and can also occur when production is not occurring.

The following case example illustrates a cost:

A school buys some new machinery, which will aid production for many years. There is an initial financial outlay when the machinery is acquired during the purchasing period, but no further payments are made while the machinery is being used during production.

However, each period of operation should be assigned a part of the cost of the machinery in order to calculate the true profit or loss of that period.

IMPORTANT NOTE ON LABOR COSTS AT AN AGRICULTURAL SCHOOL:

In the agricultural activity of small farmers there is no established payment to family members who contribute to the work in the fields, nor does the producer earn a salary. If the farm does not have that source of labor, it will have to pay laborers to carry out the work.

In the case of the FSS School we are dealing with a farm belonging to an agricultural school, in which students practice in the field the techniques they learn and therefore are not paid. Given this fact, in order to know the real cost of production, the school should take into account those unpaid salaries otherwise the resulting cost of the operation of the farm would be deceiving.

It is also true that on a conventional farm it would not be necessary to have so many laborers because production can be carried out with only a few professional laborers. Therefore we suggest you take the salaries of the technicians and faculty involved in each productive activity as the cost of labor. This will contribute to an accurate cost of the product.

c. How to classify your costs

To have a reasonable idea of the profitability of a school, it is crucial to identify and be familiar with the behavior of each of the costs involved in its activities.These costs can be classified as:

• Fixed or variable costs

• Direct or indirect costs

• Total and per-unit costs

1. FIXED COSTS

Those that do not vary in relation to the volume of production. Examples: depreciation, insurance.

2. VARIABLE COSTS

Those that are directly related to the volume of production, meaning that they increase as production increases. Examples: animal fodder, fuel, fertilizers and labor.

3. DIRECT COSTS

When the cost is directly related to the production of a given product. Examples: the value of seed and fertilizer is directly related to the production of corn.

4. INDIRECT COSTS

Those that have no relation to the production of a specific product, they are necessary for production but cannot be identified as a specific cost of any product. Example: the cost of electricity is necessary for all productive activities but it is difficult to say how much corresponds to each product.

5. TOTAL COSTS

The total production cost of for example a hectare of sesame is important information, but it is not sufficient for evaluating the efficiency of production if the production level per hectare is not taken into account.

6. PER-UNIT COSTS

The total cost per kilo of sesame takes into account both the costs and the production level, which results in better data for comparing the efficiency of production.

This is what we call per-unit cost, for example:

| • A farmer produces 4 000 kilos of sesame at a cost of $2 500.

• If we divide $2 500 by the number of units produced (4 000) we get a per-unit cost of $0.625. • This is the same as saying that each kilo cost us $0.625. |

The per-unit cost is extremely important information and enables us to:

• Fix a reasonable sale price

• Track changes in the cost of a product over time

• Compare the cost of a product with other products

• Compare our production level with other agriculture businesses involved in the same operation.

d. How to calculate the cost of a product

When calculating the cost of a product you must take all of the expenditures necessary to create a marketable product into account. These costs will provide the administrator with information about the profitability of each product, which will then enable them to make decisions about how to market the product. Remember to include the following costs in your calculations:

SUPPLIES

Refers to the costs of insecticides, fertilizers and fungicides applied to crops.

HUMAN LABOR

Includes the work of preparing the soil, planting and harvesting. Estimated hours of student labor should be differentiated as this cost does not represent cash output.

DEPRECIATION

Calculated based on the expected useful life of each asset.

OTHER COSTS

Those expenses whose value is so small it is not worthwhile to note it in detail for example buying certain utensils or materials for the harvest such as bags, baskets etc.

RENT

If the school does not own the machinery the annual amount it pays to rent them should be included.

INSURANCE

This category refers to the annual insurance premiums for certain assets such as buildings, agricultural machinery, facilities, equipment etc. These assets are used for different activities so the proportion which applies to each one should be estimated based on relative value and use.

MAINTENANCE OF ASSETS

This category includes the cost of repairs and maintenance of facilities, structures, machinery, equipment etc to keep them in good working condition.

ELECTRICITY, FUEL AND LUBRICANTS

The expense of these items should be the price the farm pays for them. In the case of fuel and lubricant only what is used during the fiscal year in question is included.

INTEREST

The only interest that should be considered in the cost of production is that which is paid on credit obtained to finance the project.

INTERNAL TRANSPORTATION

If the methods are owned or rented such as trucks, tractors with trailers etc, they should be grouped in this category. If the transport is done by people without using any mechanized or animal-drawn vehicles the work should be listed in the category of human labor.

FINANCIAL STATEMENTS

The objective of this section is to explain what financial statements are their importance in monitoring the progress of the agricultural school.

a. What are financial statements?

Financial statements are the final products of accounting. Basically they consist of charts and clarifying notes that summarize the economic and financial situation of an enterprise. This information is useful for administrators as well as other people such as shareholders, lenders and owners.

b. What are the objectives of a financial statement?

A financial statement should give the following information about an entity:

• Its net worth on the date of the statement

• A summary of the causes leading to the financial situation at that point

• The development of net worth during the period covered

• The development of the financial situation during the same period

• Other facts which will help to evaluate the amounts, timing and uncertainties of future payments that investors and lenders will receive from the entity for various reasons.

c. What is a balance sheet or a statement of financial condition?

A balance sheet shows an entity’s assets, the goods and duties that the company possesses, and its liabilities, which include its commitments and obligations to third parties. The difference between assets and liabilities is called the 'capital' or the net worth of the entity.

d. What is a profit and loss statement?

A profit and loss statement shows the variations in capital or net worth measured over the period of one year. It takes into account income from sales of goods or services, and associated costs and expenses, including taxes. The last line of the balance sheet shows the overall profit or loss. In spite of being the last line it is often the first to be read and not infrequently the only line to be read.

The profit and loss statement provides information on the causes of the result for that period, whether it is profit or loss. The profit and loss statement first lists the total income derived from the different productive activities of the agricultural school for example sales of milk, eggs, vegetables, dairy products etc and then lists the costs of carrying out each activity. The difference in the figures gives the overall result.

e. What is a cash flow statement?

One of the most important keys to keeping a school functioning is keeping an up-to-date cash flow tracking chart because if cash runs out you will have SERIOUS problems.

A cash flow statement is a profit and loss statement that covers future periods and has been modified to only show cash income and expenditure. It is an excellent tool, because it serves to predict future needs for cash before they arise.

You should estimate low, conservative numbers for income and high numbers for expenditures to make sure you will always have enough cash. The projection should be for the upcoming 12 months.

f. How to structure a cash flow tracking chart

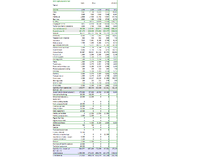

Please follow our example in Table 1 below.

In the first part we have 'Income'. In this example there is income from livestock, crop cultivation and hotel activity as well as income from academic activities.

Next expenditures arising from the operation of the school are noted. These include: salaries, electricity, telephone, insurance, etc. The result of subtracting the expenditures from the income is called 'cash flow from operations'.

Investment expenditures during the period in question, such as building work, repairs, equipment purchases, animal purchases, etc. are then subtracted from the cash flow from operations.

When the investments for the period have been subtracted we have the overall cash flow - a record of all of the cash coming in and going out during the period. The result shows the balance of cash resulting from the activities carried out over the period.

The 'starting balance' recorded in the second to last line of Table 1 is the amount of money available at the start of the period. In the first month you can manually enter the amount of your own capital which you have to start the enterprise, then add or subtract the overall cash flow for the period in question, which will give you the 'final balance' which is transferred to the next period as the starting balance and so on.

BUDGET

The goal of this section is help you use a budget to aid management planning and control.

a. What is a Budget?

It is a plan of action aimed at achieving a predetermined goal expressed in financial terms that should be carried out in a certain time frame under certain predetermined conditions.

b. What are the elements of a budget?

A budget is a plan for generating income and making expenditures. When a budget is being created it is important to:

• Create your budget for a specific period of time

• Express the budget in financial terms

• Identify all income and expenditures

In order to create a budget it is important to understand:

• The process of making a budget

• The benefits of a budget

• The factors which influence a budget

• How to budget a particular item

• How to review and make changes to the budget

c. Why should I make a budget?

A budget is important to the success of any enterprise. It identifies:

•Income - the money that is available to cover operating costs.

• Expenditure - how much will be spent.

Consider a budget to be a financial tool that will help you to:

• Set future goals

• Evaluate activities

• Decide how and when funds should be spent

• Measure results

• Identify problem areas that require attention

d. What factors influence the creation of a budget?

There are various elements that should be considered when you plan your budget:

1. Past financial trends

2. Changes in consumption of produce at the school

3. Increases or decreases in student enrollment

4. New production units being incorporated

5. Change in income levels

6. Changes in state support or any other subsidies you might have

7. Operational and programmatic changes

8. New tax laws that may cause an increase in costs

9. Annual inflation

10. Plans you may have to lower the cost of labor

11. Increase or decrease in program costs

12. Increase or decrease in the price of food, supplies or services

13. Salary increases that may be scheduled

14. Increased or additional benefits, for example life insurance for students or employees

e. How do I budget different areas?

Some areas for example food should be based on necessity. Labor costs, insurance, contracts and others can be adjusted depending upon fluctuations in price.

f. How do I begin creating a budget?

In order for the budget to be a useful tool, it is important to:

• Keep it realistic!

• Review the budget with staff from each operating unit before finalizing it.

• Make it clear to your staff that the budget will be used to evaluate the success of the program.

The key steps of the planning process are laid out below:

♦ ESTABLISH LONG-TERM GOALS

Set goals for the next 3-5 years.

♦DEVELOP A BUDGET PLAN

• Decide on budgetary categories for income and expenditures

• Decide what information to use to create and analyze your budget

• Decide how much to budget for each area or category

♦ PREDICT INCOME BASED ON THESE FACTORS

• The amount of money available from local sources

• Determine how fluctuating interest rates would affect your income

• Identify other sources of income such as subsidies, discounts and the sale of equipment

♦ CAREFULLY ESTIMATE EXPENDITURES

• The key to making a budget is estimating the year’s expenses.

• Make every effort to be precise in order to manage financial expectations.

• Create a work chart with the details of each category of expenditure.

♦ BUDGET FOR THE WHOLE YEAR

• The best option is to make a detailed budget for each month, then add together all of the months to get the total annual budget.

• Remember that some months have more holidays than others.

• The time of year will have an effect on the cost of food.

g. How can I tell if I am on the right path when making my budget?

You should check your budget and compare it to real monthly costs, comparisons by category may show tendencies or changes, for example:

• Is the quantity of milk sold or the rate of enrolment what you expected?

• Was the actual cost of food higher or lower than you had budgeted for?

• Is energy consumption and telephone use what you predicted?

h. When should I adjust my budget?

It’s important to review and adjust your budget on a monthly basis, do not wait until the end of the year. It is much better to identify a problem quickly so it can be resolved. You should ask yourself the following questions:

1. Did I check the costs of the program according to their category (costs of food, raw materials and supplies, equipment, labor costs)?

2. Did I have all staff participate in creating the budget?

3. Do they understand the importance of cost controls for the success of the operation?

An effective budget can make you a better administrator and will help you to improve and expand your program.

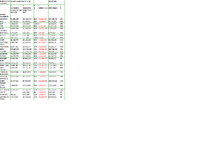

The budget table below shows the monthly production and sales of the dairy in the livestock sector of an agricultural school; in it you can see the variables that affect the calculations of monthly production and income.

The next example compares the budget to the actual performance for a specified month. This comparison allows the administrator to observe the levels of production and sales for the month.

• Column 1 shows the areas included in the budget

• Column 2 shows the actual figures for the month. This information is taken from the accounting record

• Column 3 represents the estimates from the original budget

• Column 4 indicates the difference between what occurred and what was budgeted for as a percentage

• Column 5 shows the difference in monetary terms

The next example compares the accumulated budget to actual performance through a specified month, again focusing on income. This comparison allows the administrator to observe the performance of production and sales for the fiscal year so far.

• Column 1 shows the areas included in the budget

• Column 2 shows the details of the results so far, which come from the accounting record

• Column 3 contains the accumulated budget for the period as initially planned

• Column 4 shows the difference between performance so far and what was budgeted as a percentage

• Column 5 shows the difference in monetary terms

• Columns 6 and 7 present the total amount budgeted for the year and the percentage of that which has been reached

INTERNAL CONTROL

The goal of this section is to show you the advantages of having a good system of internal control to protect the assets of the agricultural school, as well as minimize the unfortunate risks of employee corruption.

a. What are internal controls?

Internal controls safeguard and preserve the school’s possessions, minimize the risk of robbery, prevent improper use of funds and ensure that no obligations are taken on without due authorization.

b. Internal control at an agriculture school

At an agricultural school where a variety of productive activities take place and both employees and students are involved, it is particularly important to have internal controls in place so that the administrator can be sure that the goods are not mismanaged.

c. Who carries out internal controls and why?

Internal controls are carried out by the board, managers, administrators and all employees of the institution. Its goals are to:

• Promote efficient and effective business operation

• Conform with relevant laws and regulations

• Protect the organization’s assets by avoiding losses due to fraud or negligence

• Ensure the accuracy of accounting and other data used by the administration to make decisions

• Encourage compliance with the practices presented by the management

• Promote security, production quality and continual improvement

d. What are the elements of a good internal control system?

• An organizational plan that delegates authority and responsibility appropriately .

• An authorization plan, accounting record and the appropriate procedures necessary to maintain good accounting records of assets and liabilities, income and expenditures.

• Staff who are properly instructed on their rights and obligations, which should be proportional to their responsibilities.

e. What should be controlled?

Everything should be controlled but primarily all things related to the production of the various productive units, because the income of the agricultural school and therefore its self-sufficiency depends on these. The dining room is also an important cost center and warrants meticulous control over the supplies used for making daily meals.

f. How are productive activities recorded and controlled?

Charts should be the main element of internal control. These should list all the events occurring in each productive unit and record the quantity of supplies used and the quantity of items harvested or produced vegetables, eggs, milk, etc. It should also record who is responsible for each unit and be signed by those responsible for production and those responsible for storage.

These records should be generated every day without fail and turned in to the administration where the information they contain will be processed and used by the school administrator.

g. What are control charts?

Control charts serve as a tool to document the controls carried out in the various activities that make up the operation of the agricultural school. These charts should be adapted to the needs and characteristics of each of the activities.

Below are several examples of control charts for items that are produced at an agricultural school. They also serve as a basis for information provided to the administration and the data are entered into accounting software. These charts are filled out by the students of the agricultural school and checked by the person or people responsible for production.

h. How much does an internal control system cost?

An internal control system should be established after cost/benefit analysis is done. Obviously the benefit of internal control should outweigh the cost of implementation.

For internal controls to perform their mission they must be timely, clear, simple, flexible, adaptable, efficient, objective and realistic. Internal accounting controls are the base that the reliability of the accounting system rests on. Weaknesses in the internal control system should be identified by various supervisory activities and reported so that the appropriate changes can be made.

i. How do internal controls work in an educational environment?

In a FSS School in addition to the educational side of the school, there is also the business element. The internal controls in an educational/productive environment should be sufficiently reliable so as to achieve the goal of 'controlling' and 'educating' at the same time.

In an agricultural school the students are in charge of many of the operating functions of production under the supervision of technical instructors. Therefore the use of charts in all of the activities being carried out is extremely important and plays a large part in regards to internal controls.

The students should understand perfectly why the records they keep are useful; they should not think of it as just another task but rather understand that it is a tool that allows them not only to work in an organized way, but also to know what the results of their work are.

ACCOUNTING AND MENAGMENT

The goal of this section is to give you a clear idea of the advantages of acquiring a good software program as a tool for information and decision-making.

a. What is an accounting software program?

Accounting software programs are designed to systematize and simplify accounting tasks. The accounting program records and processes the financial transactions involved in a productive activity. As an example purchases, sales, debts that are owed, debts to be paid, inventory control and the payroll.

All the administrator needs to do is put in the financial information such as income and expenditures, and instruct the program to make the necessary calculations. These functions can be developed internally by the organization using the program or can be acquired from a third party, or a combination of both.

b. Why is accounting program important?

Decision-making at an agricultural school is affected by physical, biological and natural issues that cannot be modified by the producer. This means operating in a more risky environment in comparison to some other businesses.

The unique structure and working environment of an agricultural school throws up all kinds of economic, financial and technical situations. This makes the collection of reliable information particularly important for an agricultural school.

An accounting program will record the operation of the school in a simple and orderly way and provide the administrator with reliable information; which, although not guaranteeing the success of decisions, keeps them from being made in a state of complete ignorance.

c. How will this software help the edministrator?

The software will:

1. Maintain a simple record of the financial information generated at the school.

2. Interpret the information and automatically transform it according to financial, statistical and accounting techniques

3. Produce a broad range of financial and technical reports on the farm and its resources

4. Allow you to track the production levels of the school over time and to compare statistical, technical and financial data

This will make it possible for administrators with little knowledge of topics such as accounting, inventory, budgets and statistics to use the advanced techniques of accountancy in their decision making without making an excessive time commitment.

d. What kind of reports will the program produce?

• Overall assets, cash availability and bank balances.

• Liabilities, suppliers, payments to be made, bank loans.

• Forecasts and supplies.

• Quantity of items in stock.

• Per-unit costs and overall costs of inventory.

• Movement of inventory in a given period.

• Storage of products by each operating unit.

• Production and sales.

• Profit and loss statements for the farm as a whole or for one operating unit in particular.

• Details for a particular crop or operating unit - income, expenditure, the value of crops 'in the ground'.

• The work being carried out in an operating unit.

• Payment for labor - detailing the payment to each laborer, the number of days worked, the type of work carried out.

e. Why is this information important for decision-making?

Good information is crucial to good decision making and good decision making saves time, effort and energy.

These are the six rules for effective decision-making:

1. Concentrate on what is truly important 2. Carry out the process in a logical and coherent way 3. Consider both objective and subjective elements and think both analytically and intuitively 4. Have the information necessary to make a choice 5. Gather the information, opinions, etc. that have arisen in relation to the choice being made 6. Be direct and flexible before, during and after the process.

7. school.

f. What functions should the program have?

1. RECORDS

The program should keep records of:

• Crop cultivation. Including a record of all purchase and sale transactions, supplies used and expenses. It should differentiate between pasture and planted land, provide information on the estimated and final production level of each lot, the price of what is produced, harvest losses and lot allocations

• Livestock management. The various livestock activities should be recorded

• Livestock inventory. Details of overhead costs, food costs, and livestock health

• Sales and Purchases.

• Other activities. To keep track of other intermediary agricultural activities in which transaction records are more simple

• Stock. Including products to be sold, supplies, seed, grain, food and other items. Can be used to check stocks or modify existing information

• Fixed Assets. Including a description of each item with the purchase date, current value and remaining useful life

It should make it possible to record the operations of the businesses and obtain information that shows you which elements help to achieve the goals of the agricultural school and which make it less efficient.

2. RESULTS

The program should generate the financial results. This is a completely automated calculation which will:

• Integrate the accounts from the balance sheets

• Recalculate the account balances based on the transactions that have been added to the accounts up to the day of processing.

• Calculate net worth for the fiscal year, with assets, liability and sub-account administration

• Calculate variation in net worth

• Give results by possession

• Give overall results

• Generate indicators of profitability

• Show the gross margins for:

- Crop cultivation

- Livestock

- The administration

- The academic activities

- Housing

- The student dining room

- Any other business which the school has

These results are used to analyze the school’s current situation and as a starting point for deciding what steps to take to improve that situation. The program will also automatically transfer the data from the close of one fiscal year to another, making it possible to see the evolution of the establishment from one year to another. All the results generated should appear on screen and in printed form.

3. OTHER FUNCTIONS THAT THE PROGRAM SHOULD HAVE

The program should include a printed manual which describes the installation process and how to get the program started. Additionally, it should display information on screen that shows the user how to use each screen and the information that should be entered there.

• FILE BACK UP - You should make an extra copy of the important files of the software.

• CLOSE OF FISCAL YEAR - A function that will finalize the current fiscal year, transferring records of livestock and products in storage, land value and fixed assets to the next fiscal year.

The program should include a series of charts that can be used to collect data on each of the activities carried out in each of the businesses or operating units of the agricultural school. The data from these charts will then be entered into the system to be processed. The charts for data-gathering could include the following:

• LABOUR - Records the tasks carried out in each productive activity.

•LIVESTOCK TRANSACTIONS - Registers livestock transactions during the fiscal year.

• MACHINERY - Records the machinery that the institution possesses, and their respective financial repayments.

• PRODUCTION COSTS - Records the supplies used for livestock and crop cultivation activities.

• MAINTENANCE OF ASSETS - Records the costs of the maintenance of assets.

• OVERHEAD - Records the overhead expenditure that occurs during the fiscal year.

• INCOME AND EXPENDITURE - Records the income and expenditures that occur during the fiscal year.

• STOCKS - Keeps a record of supplies bought during the fiscal year.

• FIXED ASSETS AND IMPROVEMENT - Records the fixed assets the institution possesses and their respective improvements.

4. WHO CAN RUN THIS ACCOUNTING SYSTEM?

Anyone! It should be a record-keeping system for accounts and non-accountants alike.

The system should include a recording method for users who are not accountants as well as a classic record-keeping system based on credit and debit entries for people with accounting knowledge.